04/17/2023

What is Money?

Money is one of the most fundamental inventions of human civilization. It allows us to exchange goods and services with each other, regardless of whether we have a direct need for what the other person has to offer. But what is money, exactly? And why do we use it?

When you hear the term “money,” what comes to mind? Depending on where you are in the world, you think of the United States Dollar, the Euro, the Chinese Yuan, the Russian Ruble, or another national currency. The modern concept of money is closely tied with national currencies but was it always this way? More importantly, will it always be this way?

The concept of money is unfamiliar to many people but a deeper understanding will explain a lot about why the world today is the way it is.

What is money?

What is the history of money?

How does money work?

Understanding the answers to these questions will show you how the concept of money is fluid throughout human history. The answers will also teach you something else – why your money is broken.

What is the concept of money?

The basic description of money is that it is a medium of exchange. Person A wants to exchange with Person B and money is the way to do so.

Before the concept of money, humans used a barter system. A barter system is a system of trade in which goods or services are exchanged directly for other goods or services without the use of money.

For example, if Person A has eggs and Person B has apples then Person A can exchange the eggs for the apples offered by Person B. Boiled down, a barter system is when you trade something with somebody who wants it in exchange for something that you want. It is a trade.

Bartering systems have some problems.

First, what happens if you can’t find somebody who wants what you have to offer?

Using the example above, what happens if Person A has eggs and wants apples, but Person B wants a cow? Person A would need to find a way to get a cow to trade with Person B. Another option is if Person A and Person B can find Person C that is interested in having a three-way trade. This gets complicated quickly and makes trades slow and inefficient.

Another problem is that some things are hard to divide up into smaller parts. For example, if you had a cow and wanted to buy a pencil, it would be hard to divide the cow into smaller parts to pay for the pencil.

What is the solution to these problems?

The solution is to develop a medium of exchange with an agreed upon value to facilitate trade.

That is what money is. Money is a medium of exchange with an agreed upon value.

So, how did the concept of money catch on with people that were used to bartering? The societal development of a monetary system focuses on three functions.

The monetary system functions as:

- A Medium of Exchange – This refers to an item or system that is used to facilitate transactions between parties. It can be anything that both parties agree to use as a means of payment.

- An Unit of Account – A measure used to value goods and services, debts, and other financial transactions within an economy. It allows for a standardization of prices and facilitates economic calculation and comparison.

- A Store of Value – This refers to the function of money or another asset to retain its purchasing power over time. It allows people to save their wealth for future use.

Remember: anything can be used as money if the parties involved agree.

Can shells be money? Yes.

Can rocks be money? Yes.

Can pieces of paper be money? Yes.

Anything can be used as money if the involved parties agree.

Examples of money through history:

Cowrie shells: These small, shiny shells were used as money in many parts of the world, including Africa, Asia, and the Pacific Islands. Because of their portability and difficulty to counterfeit, cowrie shells served as an excellent form of money. Some nations even preferred these shells over gold.

Cowrie shells like these have been used as money throughout history.

Rai stones: These large, circular stones were used as currency on the island of Yap in Micronesia. The stones were so heavy that they were never actually moved during transactions – instead, ownership would be transferred verbally.

An 8 foot Rai stone in the village of Gachpar.

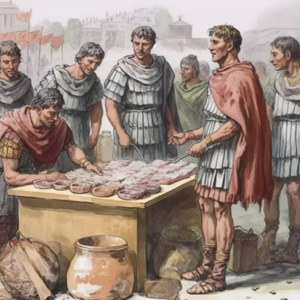

Salt: In ancient Rome, salt was used as a form of payment for soldiers. The Latin word for salt is “sal.” The monthly allowance of pay was called “salarium,” which is where the word “salary” comes from.

Salt being used as money to pay Roman soldiers.

Cacao beans: The Mayans used cacao beans (the same kind in your chocolate bar) as a form of money to pay workers, The Mayans also used maize to transact and pay taxes.

Cacao beans (cocoa beans before they are roasted to make products like chocolate)

Beads: Many cultures have used beads, often made from precious materials like ivory or amber or materials like shells and glass, as a form of currency.

Beads have had monetary value throughout history.

Tobacco: In colonial Virginia, tobacco was used as a form of currency, with prices set in pounds of tobacco that were used to pay taxes and fines.

Growing your money to pay taxes with it.

As you can see, money can come in any form as long as that form is accepted.

These examples are known as “commodity money.” Commodity money is a type of money that has intrinsic value based on the material it is made of, such as gold, silver, or cowrie shells. Commodity money differs from fiat money, which is a type of money that has no intrinsic value and is not backed by a physical commodity. Its value is based solely on the trust and confidence of the people using it and the government that issues it. Money like the US Dollar, Euro, and Yuan are examples of fiat currency.

But commodity money had some problems. It wasn’t always easy to find the right type of a commodity that everyone would accept. It was also hard to carry around large amounts of shells, stones, or beads.

Eventually, people started using metal coins as money. The first coins were made in ancient Greece around 600 BC. The coins had a picture on them that showed their value, so people didn’t have to weigh them to know how much they were worth. Coins were easier to carry around and could be used for smaller purchases.

More time passed and paper money was invented. The first paper money was used in China around 900 AD. Paper money was easier to carry around than metal coins and it was also harder to counterfeit.

Over the centuries, the physical representation of money has shifted but the concept of money remains an important element to the fabric of society. A stable monetary system is fundamental to a peaceful and prosperous society.

Why does money matter?

As the needs and functions of society have evolved, so too has money.

Today, we use a variety of things as money, including coins, paper money, and digital currency. Money makes it easier for us to buy and sell things, and it helps us to measure the value of goods and services.

Imagine you have a lemonade stand and you want to sell cups of lemonade. You could accept payment in many different forms, like beads or cowrie shells. If you did, it would be hard to figure out how many beads or cowrie shells a cup of lemonade is worth. It would also be difficult for your customers to carry around all the different types of beads and shells to pay for things.

So, people agreed to use coins, paper money, or digital currency as a medium of exchange. This makes it easier to figure out the value of things and to carry around the money you need to buy the things you want.

Now, why does money have value? There are characteristics of money that give it value, but these characteristics can be condensed into one fundamental reason: belief.

The value of money is based on people’s belief that it is worth something.

For example, a dollar bill is just a piece of paper, but people believe it is worth something because they know they can use it to buy things they want.

People believe that the dollar is backed by gold but the dollar hasn’t been backed by gold since 1971. The reality is that the dollar has value because people believe it has value (and because the American government will enforce this belief by using the American military to “convince” doubters).

The government plays a role in the value of money. The high-level explanation is that they print the money and make sure there is not too much or too little of it in circulation. If there is too much money, it can lead to inflation, which means the prices of things go up. If there is too little money, it can lead to a recession or depression, which means there is not enough money for people to buy things they need.

Money works because people agree to use it as a medium of exchange, and its value is based on people’s belief that it is worth something and the government’s role in regulating its supply. Understanding the history of money, how it works, and how the medium used to represent money can change will help you understand how and why digital currency is the money of the future.